Reuters

By Julie Ingwersen

* Morocco buys U.S. wheat, triggering short-covering

* CBOT wheat gains against Minneapolis as spreads unwind

* Corn choppy, underpinned by wheat

* Soybeans lower as private firms raise yield estimates

U.S. wheat futures rose about 3 percent on Wednesday as signs of fresh export demand triggered a short-covering rally in a market where commodity funds hold a large net short position, traders said.

Corn futures were choppy, paring early declines as wheat advanced. But soybeans fell, pressured by the expanding harvest of a likely record-large U.S. crop.

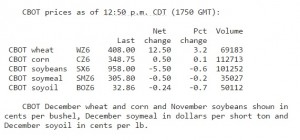

At the Chicago Board of Trade as of 12:56 p.m. CDT (1756 GMT), December wheat was up 12-1/2 cents at $4.08 per bushel, December corn was up 1/4 cent at $3.48-1/2 a bushel and November soybeans were down 3-3/4 cents at $9.59-3/4 a bushel.

Wheat rose on news that Morocco’s grain agency bought 260,000 tonnes of U.S. wheat. “I think the Moroccan business helped a little bit,” said Tom Fritz, partner with EFG Group in Chicago. “Now the shorts are falling all over themselves to get out, just based on the price action,” Fritz said.

The U.S. Commodity Futures Trading Commission’s latest commitments report showed that as of Sept. 27, non-commercial traders held the fourth-largest net short position in records dating to 2006. That big net short left the wheat market vulnerable to short-covering rallies.

CBOT wheat and K.C. hard red winter wheat gained against Minneapolis Grain Exchange spring wheat futures as traders exited long Minneapolis/short Chicago and K.C. wheat spreads.

MGEX spring wheat has been rising since late September on worries about tight supplies of top-quality milling wheat. But the MGEX December contract pared gains after reaching a three-month high at $5.33-1/2 a bushel, just above its 200-day moving average.

The bounce in wheat helped underpin corn futures, which were nearly flat late in the session.

But soybean futures fell on expectations for record-large yields. Informa Economics, a private analytics firm, forecast U.S. 2016 soybean production at 4.3 billion bushels with a yield

of 51.6 bushels per acre (bpa), trade sources said.

Earlier this week, commodity brokerage INTL FCStone raised its soybean yield estimate to a record 52.5 bpa.

Both firms’ yield figures were above the U.S. Department of Agriculture’s last official forecast of 50.6 bpa, signalling a possible increase when the government updates its figures on

Oct. 12.

“Rising yield estimates and increasingly bearish chart signals continue to weigh on the oilseed,” INTL FCStone Chief Commodities Economist Arlan Suderman wrote in a note to clients.

(Additional reporting by Colin Packham in Sydney and Gus Trompiz in Paris,; editing by William Hardy and Marguerita Choy)